You can link your Declaree administratie to Twinfield to export reports as journal entries. This article explains how to set up the connection, what configurations are required, and how to export reports correctly.

Step 1: Connect to Twinfield

-

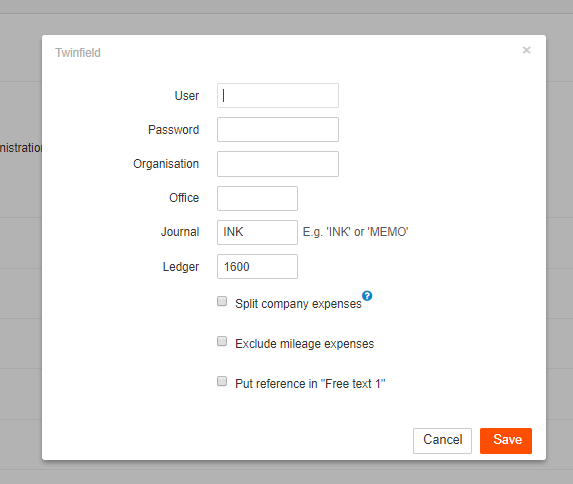

Go to Admin → Connections.

-

Select Twinfield.

-

Log in with your Twinfield credentials

Note: Declaree supports exporting only to Twinfield journals of type INK, MEMO or PNV. Make sure you select one of these journal types during setup.

1.1 Split Company Expenses (Optional)

If your organisation uses company credit cards and the expenses shouldn’t be reimbursed to the employee, enable the Split company expenses option.

This ensures that:

-

Company-paid expenses are exported separately.

-

A different creditor (e.g. the card issuer) is assigned.

-

Each entry is booked correctly in Twinfield.

1.2 Link to proof in Twinfield (Optional)

To add a direct link to the proof in Twinfield, set the following URL in Free Text Field 1 in your Twinfield journal settings:

https://app.declaree.com/declaree/reports/$FreeText1$/pdf

This creates a clickable link to the report PDF in Declaree.

Note: The person opening the link must have a Declaree account with permission to view the report (e.g. as an accounting or admin user).

Step 2: Configure your setup

Make sure the following elements are in place:

-

Creditor number per user

Each user needs a creditor number to link expenses to the correct supplier in Twinfield.

-

General ledger accounts per category

Add a ledger account code to each category to book expenses to the right account.

-

VAT codes

Use VAT codes in Declaree that exist and are accepted in Twinfield.

default VATS: IH (21%), IL (6%), IN (0%/none) -

Cost centres (if applicable)

Add cost centre codes in Declaree if they’re used in your accounting setup.

Step 3: Export your reports

Once everything is set up:

-

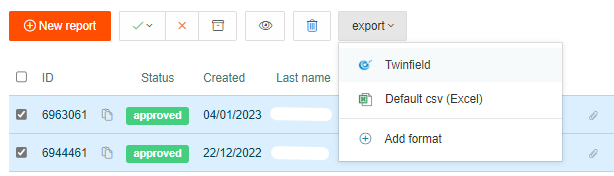

Go to Reports.

-

Select the approved reports you want to export. Make sure all expenses are complete and correctly filled in.

-

Click Export and choose Twinfield as the destination.

Declaree will send the reports to Twinfield as journal entries, following the configuration you’ve set.

Common errors when exporting to Twinfield

Here are a few common issues that can prevent a successful export and how to fix them:

❌ Missing creditor number

What it means: The user doesn’t have a creditor number assigned in Declaree.

How to fix it: Go to Admin → Users and add the creditor number under the user’s profile.

❌ Missing general ledger account

What it means: One or more categories don’t have a linked general ledger account.

How to fix it: Go to Admin → Categories and assign an account number to each category used in the reports.

❌ Invalid or missing VAT code

What it means: The VAT code used in Declaree doesn’t exist in Twinfield, or it’s not allowed in the selected journal.

How to fix it: Go to Admin > Vats and make sure the VAT codes match the ones configured in Twinfield.

-

default VATS: IH (21%), IL (6%), IN (0%/none)

❌ No cost centre (when required)

What it means: Your Twinfield environment expects a cost centre, but it’s missing from the export.

How to fix it: Go to Admin > Projects and add the relevant cost centres