Employers in the Netherlands with 100 or more employees are required to report annually on work-related personal mobility (WPM) as of July 1, 2024. With Declaree, you can easily prepare this report using the WPM module.

This guide walks you through what you need to know and how to get started in Declaree.

1. What is the WPM requirement?

The Dutch government wants insight into CO₂ emissions caused by work-related travel. Organizations are required to submit annual data on:

-

The number of kilometers employees travel for business and commuting.

-

The type of transportation used (e.g., car, bike, public transport) and the corresponding fuel type.

-

Public transport expenses for business travel must be reported in total euros, separate from commuting.

For more information, visit the RVO website.

2. Data collection that meets official requirements

The WPM module helps your organization gather and export the required data. Declaree automatically collects relevant data based on the type of trip or expense. The report distinguishes between four categories:

-

Business travel – Company vehicles

Travel with lease cars or company-owned vehicles.

-

Business travel – Service providers

Travel using mobility cards or other external transport services.

-

Business travel – Reimbursements

Trips for which employees submit expense claims.

-

Commuting

Kilometers traveled between home and work.

Declaree processes this data in line with the RVO reporting requirements.

3. Reporting public transport in euros

For business travel using public transport, organizations must report the total amount spent (in euros).

Declaree helps you do this by automatically labeling public transport expenses and assigning them to the correct category.

⚠️ Note: When employees commute using public transport, you only need to report the distance in kilometers — not the amount spent.

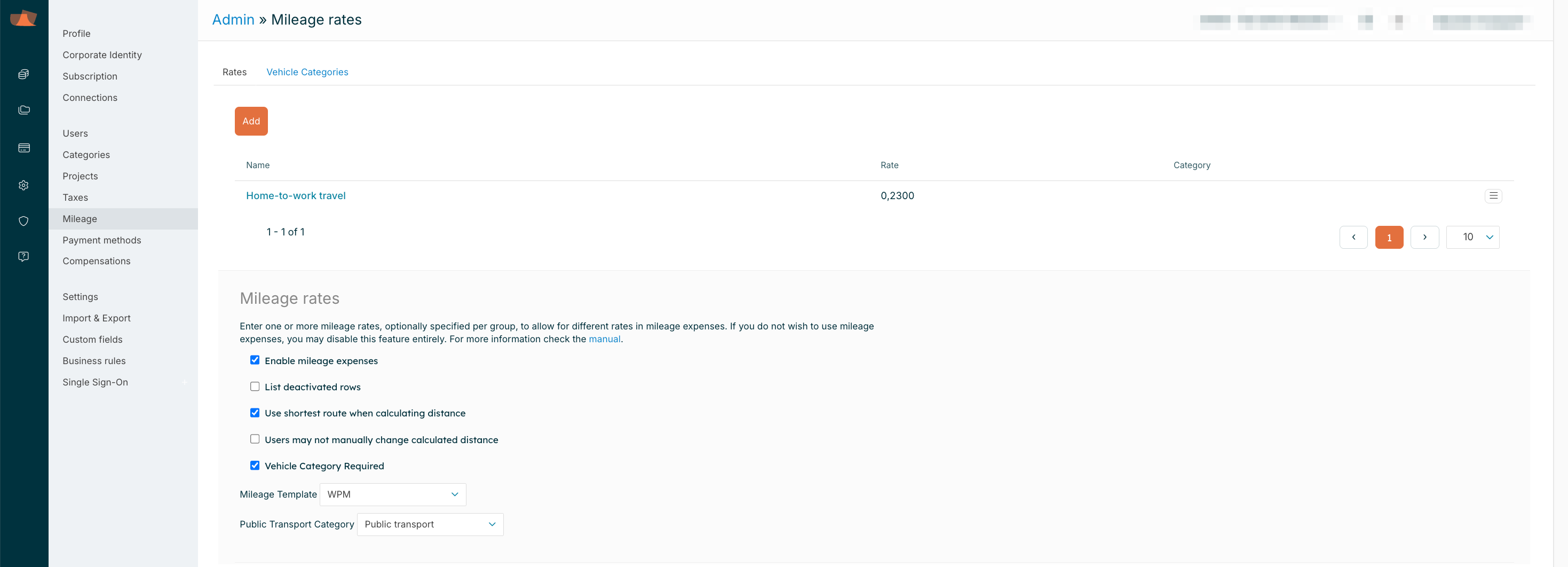

4. Easy setup with the WPM template

Once we’ve activated the WPM module for you:

-

You can select the WPM template in the mileage settings.

-

The official vehicle categories will be loaded automatically.

-

Your existing mileage rates will remain unchanged.

Assigning a category for public transport

Because public transport costs are treated as expenses, an admin must manually assign a relevant expense category. Here’s how:

-

Go to Configuration → Mileage.

-

At the bottom, select the expense category you’d like to use for public transport.

-

Save your changes.

This ensures public transport costs are correctly included in your report.

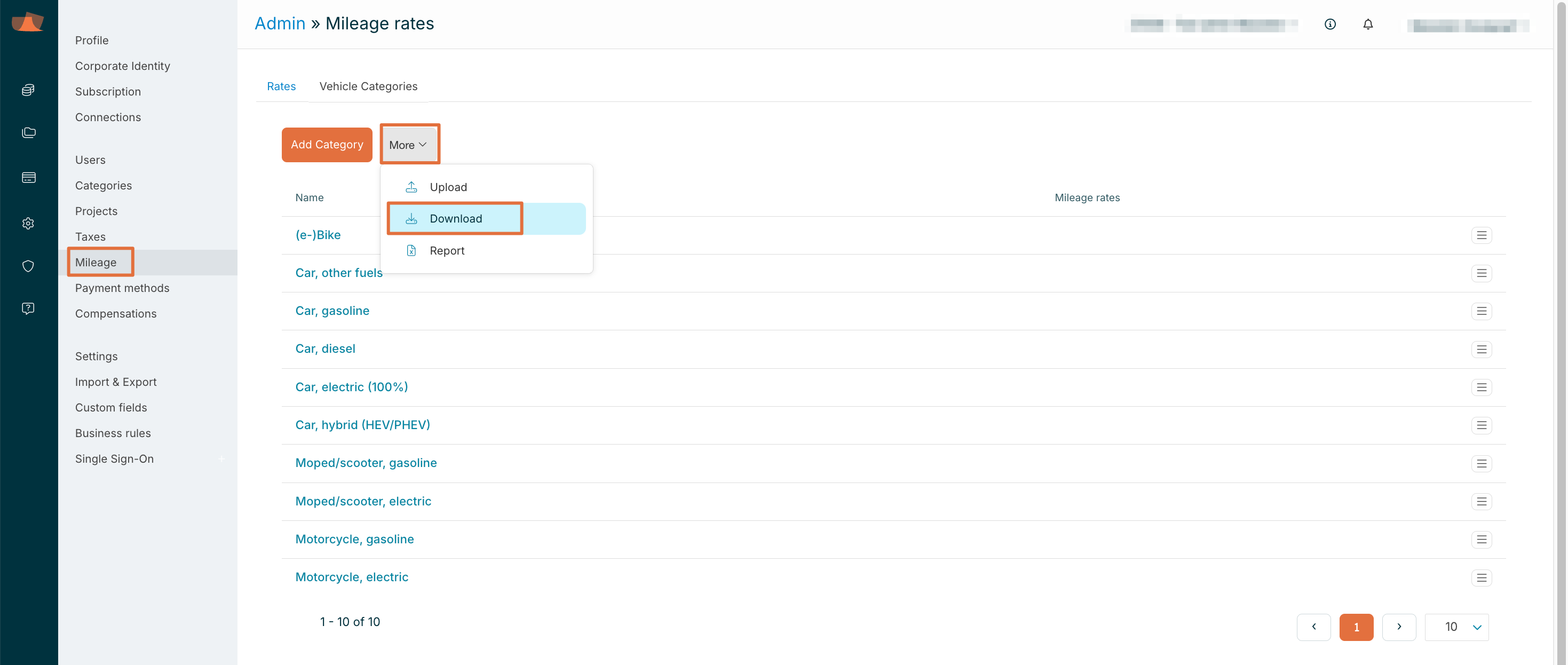

5. Exporting data for RVO reporting

Once the module is activated, admins can easily export the required data each year. The export includes:

-

The total number of business kilometers per calendar year, broken down by vehicle type (e.g., car, bike, public transport) and fuel type.

-

The total amount spent on business-related public transport.

To export the data in Declaree, go to:

Settings → Mileage → Vehicle categories >More → Report.

6. Module activation and support

The WPM module is a paid module and must be activated by us. Want to get started or have questions? Please contact our support team.