The Payment Methods module is relevant for your company if you use corporate credit cards. It allows you to match expenses paid with a credit card to the corresponding transactions on your credit card statement. This way, Declaree helps you verify whether all receipts for corporate card expenses have been uploaded correctly.

Setting up a credit card payment method

Before you can match expenses, you’ll need to configure the credit card in Declaree:

-

Go to Configuration → Payment Methods.

-

Click Add to create a new payment method.

-

Fill in the following fields:

-

Name of Cardholder : Use the exact name as shown on the credit card or statement.

-

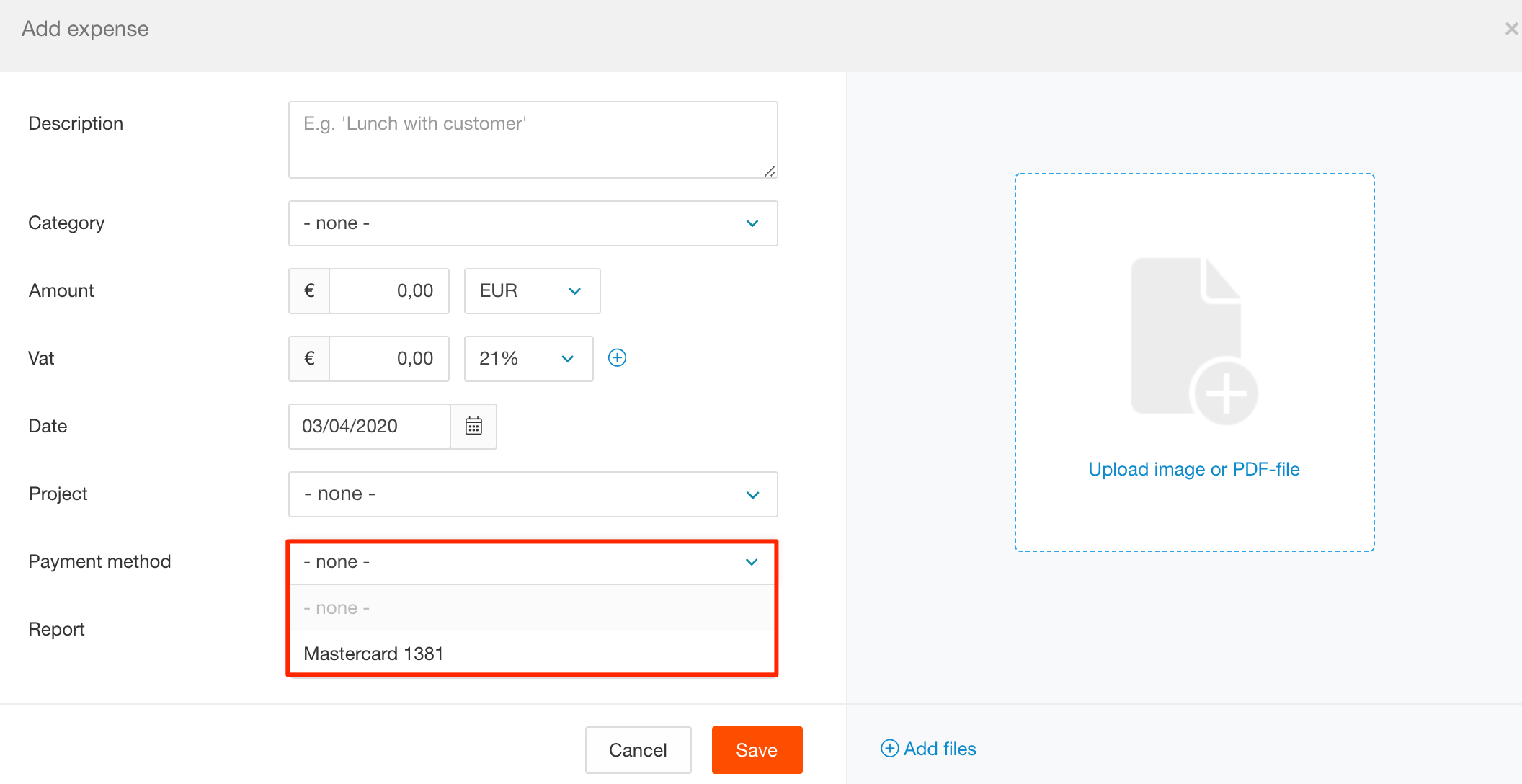

Name: Include the last 4 digits of the card (e.g. Mastercard 1381).

-

Code: If needed by your Accounting or Payroll department, you can add a code or creditor to the credit card. This will appear in the data export and allows accounting to distinguish between reimbursable and non-reimbursable expenses.

-

Assignee: Assign the card to the relevant user.

-

Type: Corporate vs. Business Credit Cards

Corporate Credit Card

-

Statement goes to the company as a consolidated overview.

-

Employees cannot view this statement to protect colleagues’ privacy.

-

Only the admin can upload it to Declaree.

Business Credit Card

-

The statement is sent directly to the employee.

-

It only contains that employee’s transactions.

-

The employee can upload the statement themselves and add or remove transactions.

Matching expenses

Declaree offers two ways to match expenses with your credit card transactions:

Using payment methods with expenses

-

For manual PDF uploads, users can add the receipt and select the payment method beforehand. Once the PDF statement is uploaded, these pre-filled expenses can be easily matched with the transactions on the statement.

-

With a data feed, expenses are created automatically and the payment method is pre-filled.

-

If an expense wasn’t paid by credit card, select –none– as the payment method. Declaree doesn’t differentiate between cash and debit card payments, as these are usually reimbursable.

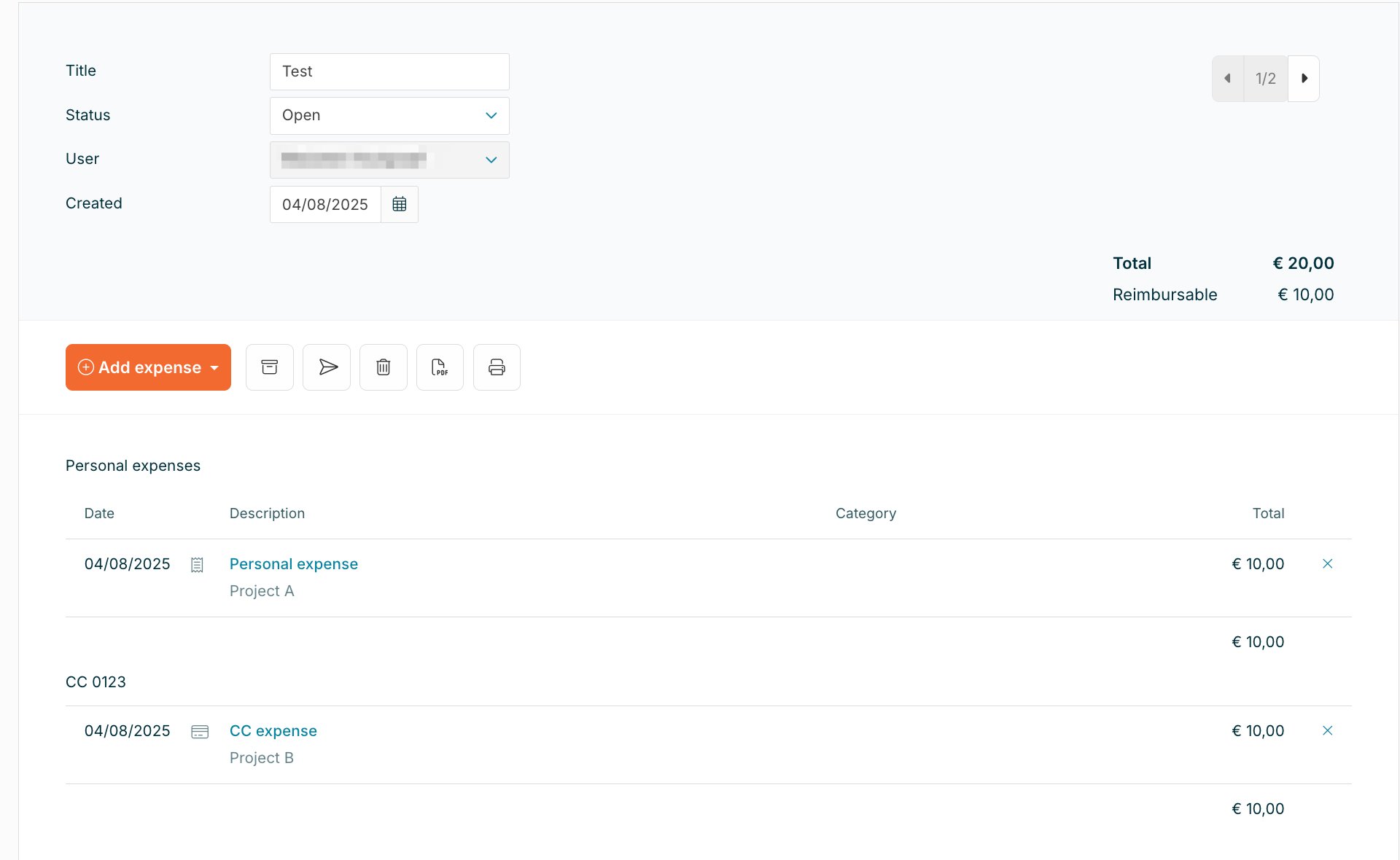

Afterwards, when users open their report in Declaree, they can immediately see whether an expense is reimbursable or non-reimbursable. Expenses paid with a corporate card are grouped under the card name (e.g. Mastercard 1381), while personal expenses appear in a separate section.